Features and Benefits

-

Secure and Easy KYC Process

Secure and Easy KYC Process

-

Data usage authorised as per SEBI regulations

Data usage authorised as per SEBI regulations

-

Centralized KYC data storage

Centralized KYC data storage

-

One-time KYC across all accounts

One-time KYC across all accounts

-

Standard KYC process and documentation

Standard KYC process and documentation

-

24/7 System Access to registered Intermediaries

24/7 System Access to registered Intermediaries

-

2 Factor Authentication

2 Factor Authentication

-

Access and Usage Audit Trail fully mapped

Access and Usage Audit Trail fully mapped

-

Cyber Security Principles implemented

Cyber Security Principles implemented

-

Robust Disaster Recovery BCP plans

Robust Disaster Recovery BCP plans

- Investor

- Intermediary

Investor

-

One-time KYC for Anytime and Anywhere Usage

One-time KYC for Anytime and Anywhere Usage

-

Common KYC across all Intermediaries

Common KYC across all Intermediaries

-

Automatic updation across all Intermediaries

Automatic updation across all Intermediaries

-

KYC Access only with your permission

KYC Access only with your permission

-

Receive instant alert of KYC access by Intermediaries

Receive instant alert of KYC access by Intermediaries

Intermediary

-

Multiple Convenient Interfaces

Multiple Convenient Interfaces

-

Quick KYC Verification

Quick KYC Verification

-

Easy KYC Modification

Easy KYC Modification

-

API based service functionality

API based service functionality

-

KYC support for Equities, Mutual Funds, and C-KYC

KYC support for Equities, Mutual Funds, and C-KYC

-

Biometric and OTP based Aadhaar KYC

Biometric and OTP based Aadhaar KYC

-

Dedicated Customer Support

Dedicated Customer Support

-

Easy Integration Kit

Easy Integration Kit

-

Quick Go Live

Quick Go Live

-

24/7 System Access for KYC Verification

24/7 System Access for KYC Verification

-

Real-time MIS Reports

Real-time MIS Reports

USP

- Lowest Turn around Time for KYC Processing

- ISO 27001 for Information Security & Strong BCMS

KRA Benefits

Prevents duplication and inconvenience to investors

Enables single point change management

Enables one-time KYC

Enables single request KYC changes

Eliminates physical collection of KYC documents

Solutions for Stock Brokers, Mutual Funds, Debt Intermediaries, PMS, AIF & Banks

To partner with us

Click Here

Why NDML KRA?

Uniform one-time digital KYC for investors

No duplication of KYC effort

An Investor can open multiple accounts with single KYC

KYC changes communicated instantly to intermediaries

Intermediaries can view and download KYC information

Key Statistics

More than

1500+

Registered Intermediaries

More than

1500+

Registered Intermediaries

More Than

1.37 Cr.

KYC of Investors

More Than

1.37 Cr.

KYC of Investors

50 Lakh+

KYC Update / Modifications

50 Lakh+

KYC Update / Modifications

More Than

2.5 Cr.

KYC Records – Intermediary Relations

More Than

2.5 Cr.

KYC Records – Intermediary Relations

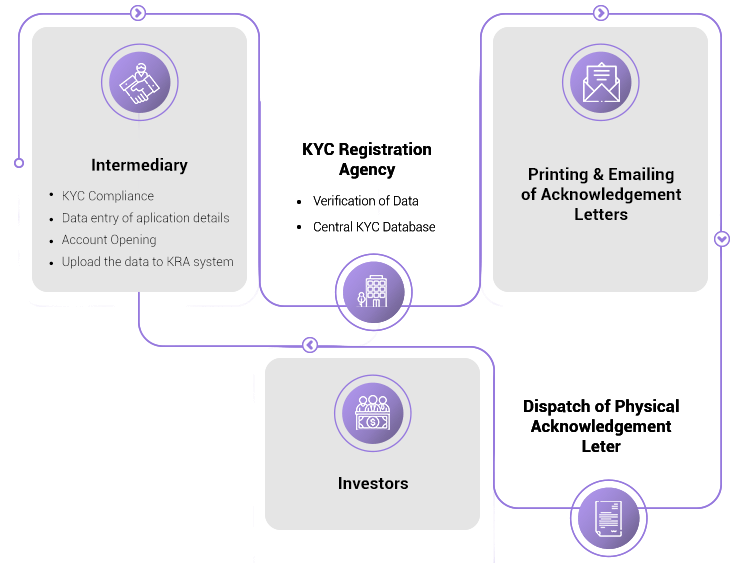

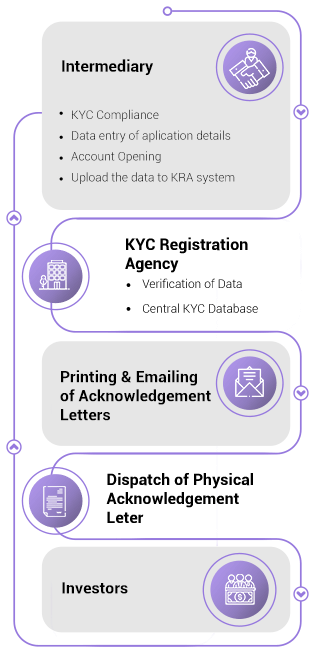

Process Flowchart

Key Officials

Mr. Prashant Prachand

- Help Desk: 022-49142600/01/02/04/05/06

- Designation: Grievance Officer

- Email-Id: PrashantD[at]ndml[dot]in

Mr. Vijay Gupta

- Help Desk:022-49142600/01/02/04/05/06

- Designation: Department Head

- Email-Id: VijayG[at]ndml[dot]in

Mr. Vijay Gupta

- Help Desk:022-49142506

- Designation: Compliance Officer

- Email-Id: ndml.complianceofficer[at]ndml[dot]in